30+ how to lower dti for mortgage

Estimate Your Monthly Payment Today. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

How Debt To Income Ratio Dti Affects Mortgages

Web To calculate your DTI ratio you can divide your minimum payment and debts 2000 by your gross monthly income 5000.

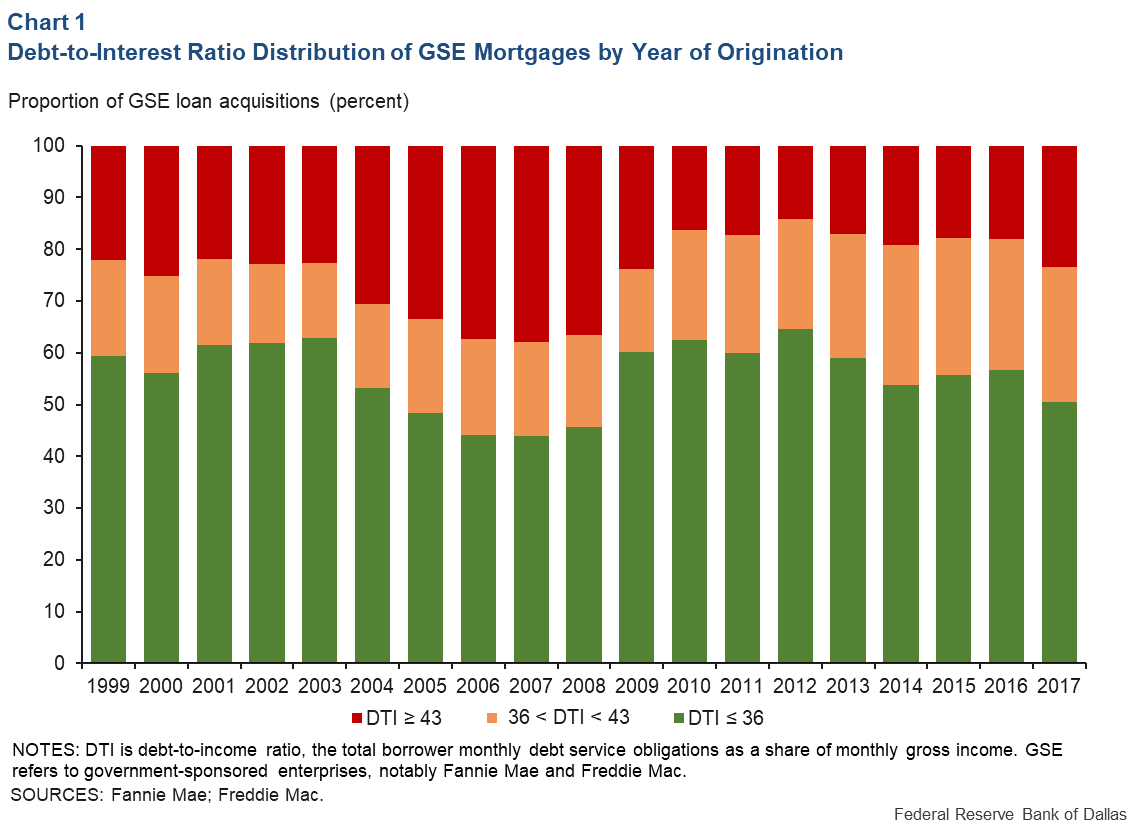

. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Compare Apply Directly Online. Web As a general rule mortgage lenders require a DTI under 43 but may prefer a DTI below 36 on conventional loans.

Web Improve your credit score. Web Consolidating your debt could also lower the interest rate you pay on it. Web Eris Saari.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. For example if your monthly debt payments are 1500 and. Like good credit a low DTI ratio helps you secure the best interest rates and terms on a loan.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Trusted VA Home Loan Lender of 300000 Military Homebuyers. To get the back-end ratio add up your other debts along with your housing expenses.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web DTI is expressed as a percentage that is determined by dividing your monthly minimum debt payments with your gross monthly income pre-tax income. Web A lower DTI ratio indicates that you have enough money coming in to handle taking on another regular payment.

One key metric that many lenders consider is a consumers debt-to-income DTI ratio. The result is your DTI ratio. Increase your monthly income.

In this scenario the result would be 040 or 40. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

The average rate for a 30-year fixed mortgage is 689 percent down 2 basis points over the last week. Web 5 ways to lower DTI 1. Pay down high balances The higher the balances on debts the higher your DTI.

Web If John is able to both reduce his monthly debt payments to 1500 and increase his gross monthly income to 8000 his DTI ratio would be calculated as 1500. Ad 30 Year Mortgage Rates Compared. Ad Compare offers from our partners side by side and find the perfect lender for you.

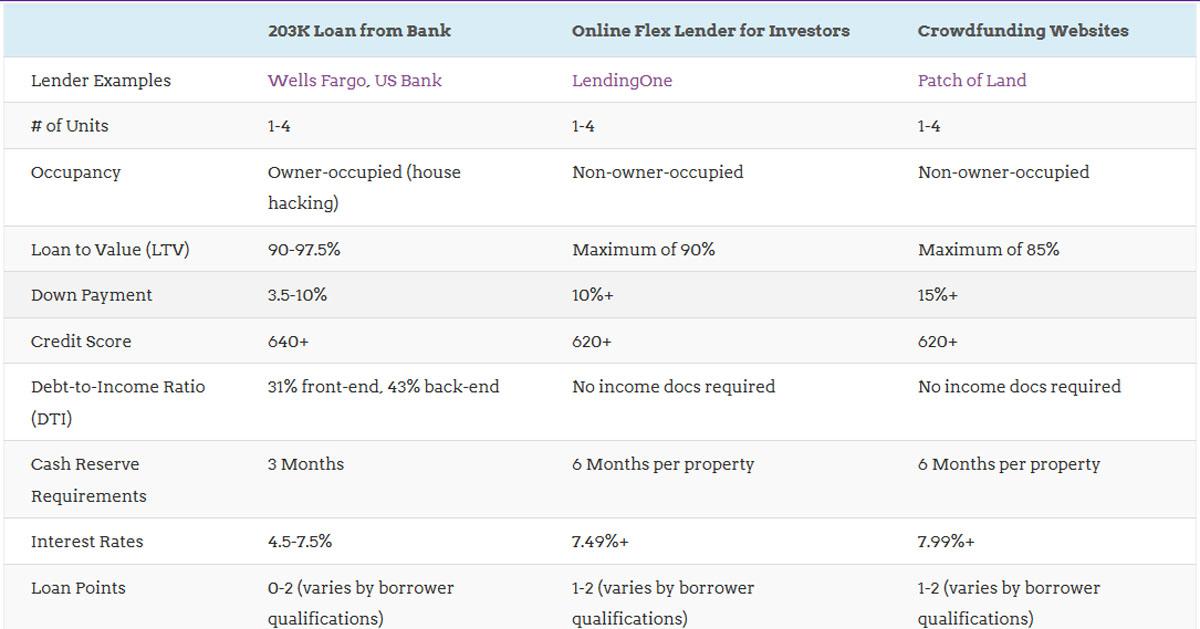

Low-income borrowers can take advantage of FannieMaes HomeReady mortgage program or Freddie Macs Home. 2022s Top Mortgage Lenders. Compare Now Save.

Heres how lenders typically view DTI. Lower your debt-to-income ratio or make on-time payments to improve your credit score and qualify for the best rates. Lets say youre buying a house and you have calculated your front ratio or the comparison of your proposed housing debt to your.

When you refinance having less. Web Make the decision to pay off your credit card balances as fast as possible to lower your monthly payments and debt to income ratio. Web 19 hours agoNo down payment is required for these loans.

Select Apply In Minutes. Web Current 30 year mortgage rate slides -002. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Some mortgage lenders do not rely solely on an acceptable debt-to-income ratio also called DTI or DTI ratio for mortgage approval but a high DTI is typically a. Compare Apply Directly Online. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender.

For FHA mortgages and other unconventional home loans. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken.

Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. And that could result in lower monthly payments and a lower debt-to-income ratio.

Web Your front-end or household ratio would be 1800 7000 026 or 26. Web From a lenders perspective the lower your DTI the better. Take a look at all your debts and figure out which one has the.

More Veterans Than Ever are Buying with 0 Down. The ideal DTI is 36 according to the Consumer. Web 54 minutes agoMortgage lenders will also consider the other debt obligations you have.

Web Divide the total debt payments by your monthly income and multiply by 100.

How To Get Past Debt To Income Ratio When Buying Another Property Quora

6 Top Ways To Lower Your Debt To Income Ratio Tally

How Your Debt To Income Ratio Can Affect Your Mortgage

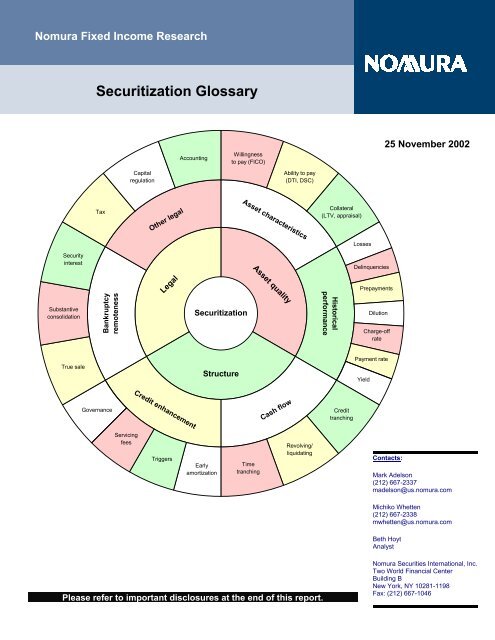

Securitization Glossary Mark Adelson

With Fewer People Being Able To Afford Homes Freddie Mac Seeks Widespread Expansion Of 3 Down Mortgages Dr Housing Bubble Blog

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

Effects Of Easing Ltv Dti Regulations On The Debt Structure And Credit Risk Of Borrowers

Acuma Pipeline Magazine Winter 2020 By Acuma Issuu

G312656 Jpg

:max_bytes(150000):strip_icc()/GettyImages-620924135-5715b45c3df78c3fa26c410c.jpg)

Lower Your Debt To Income Ratio

Debt To Income Dti Ratio Guidelines For Va Loans

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

5 Tips And Tricks To Lower Your Debt To Income Ratio

How Much Home Can I Afford Hunter Galloway

Quizzle S Back To Basics Guidebook

Compare Investment Property Loans Rental Property Mortgage Rates

Republic Of Tajikistan Financial System Stability Assessment Report In Imf Staff Country Reports Volume 2016 Issue 041 2016